Yesterday, the United States government took a significant next step in its fight against the continuing coronavirus pandemic. The Families First Coronavirus Response Act, signed into law on Wednesday, March 18, 2020, aims to slow the progression of COVID-19 by extending and expanding valuable benefits available to workers impacted by the spread of this disease.

The FMLA expansion and paid sick leave provisions apply only to private employers with fewer than 500 total employees. Both allow employers of employees who are healthcare providers or emergency responders to exempt these employees. Both provisions also allow exemptions for small businesses with fewer than 50 employees when the potential negative impact of these provisions could be significant.

Two key provisions of this law – Family Medical Leave Act (FMLA) expansion and paid-sick leave obligations – are the focus of this update. Noteworthy for today, the law also requires health plans and insurers offering group or individual health insurance to cover both COVID-19 diagnostic testing and services tied to the administration of the test.

COVID-19 FMLA Expansion:

This provision takes effect no later than 15 days from its passage (April 1, 2020) and will remain in place through the end of 2020. It amends the FMLA to allow employees who are unable to work in any capacity to take leave to care for their own children under the age of 18 if the child’s day care, elementary or secondary school closes or temporarily transitions to cyber-learning as a result of this public health emergency. COVID-19 FMLA expansion also:

- Is available to any employee who is employed for at least 30 calendar days.

- Pays out at a rate that equals two-thirds of the employee’s regular rate of pay to a daily cap of $200 and $10,000 in total.

- Allows employers to provide the first 10 days of leave on an unpaid basis. If the first 10 days of leave are unpaid, the employer must afford the employee the option of using any accrued vacation, paid time off, or personal leave time to cover the unpaid period.

COVID-19 Paid Sick Leave

This provision obligates applicable employers to immediately make 80 hours of paid sick leave available for full time employees. Similarly, for part-time employees, the time made available equals the average number of hours worked over a two-week period. COVID-19 paid sick leave also:

- Can be leveraged by employees for whom any of the following conditions apply:

- The employee is subject to a federal, state, or local quarantine or isolation order related to COVID-19.

- The employee is advised by a healthcare provider to self-quarantine due to concerns related to COVID-19.

- The employee is experiencing symptoms of COVID-19 and seeking a medical diagnosis.

- The employee is caring for an individual who is subject to a federal, state, or local quarantine or isolation order or is advised to self-quarantine due to COVID-19 concerns.

- The employee is caring for their son or daughter if the school or place of care of the son or daughter is closed, or the childcare provider of the son or daughter is unavailable, due to COVID-19 concerns.

- The employee is experiencing any other substantially similar condition specified by the Secretary of Health and Human Services, in consultation with the Secretary of the Treasury and the Secretary of Labor.

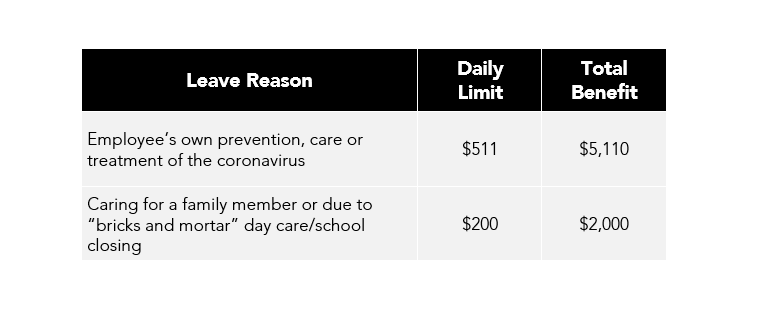

- Pays out at the employee’s regular rate of pay with daily and aggregated maximums determined by the specific reason the employee is leveraging the paid sick leave:

- Must be made available, immediately and in its entirety – there is no accrual rate or period.

- Does not include a carryover provision – it cannot be carried over from one year to the next if left unused.

- Is not paid out by an employer when left unused by an employee who separates employment.

While clarification would be welcome, we believe that from a coordination standpoint (expanded FMLA and paid sick leave), an employee who opts to immediately use the 80 hours of paid leave available to care for an out-of-school/care child would concurrently initiate the unpaid portion of the expanded FMLA provision.

What We Make of What This New Law Means for Employers:

If it has not done so by now, the restrictions imposed by the current, historic coronavirus pandemic should provoke all remaining employers to revisit their remote work, time off, sick and leave benefits and related policies. Certainly, employers of less than 500 employees will need to consider how they will operationalize, finance (employers pay the benefits now and receive a payroll tax credit later) and communicate these expanded benefits. Practical considerations include:

- Carefully reviewing your existing policies around time off as well as paid and unpaid leave in an effort to maximize the benefits made available to employees.

- Determining how (or how different) your notification procedures will need to be in order to factor in (and potentially track to) these new dynamics.

- Developing a clear communications strategy, one that enables your employees to understand the steps you are taking to try to help them through this process and what is required of them in order to leverage these benefits.

- Promoting today’s distancing response measures by transitioning as many employees as possible to a work from home arrangement. Doing so is one of the main buffers available that prevents the potential need to use the benefits made available under this new law.

Employers also should check with their health plans and insurers to understand their positioning with respect to COVID-19 diagnostic testing and services coverage requirements.

Baker Tilly Vantagen professionals are committed to monitoring this highly fluid situation and are here to offer guidance and recommendations on the steps you can take to ensure compliance as well the health and safety of your workforce.